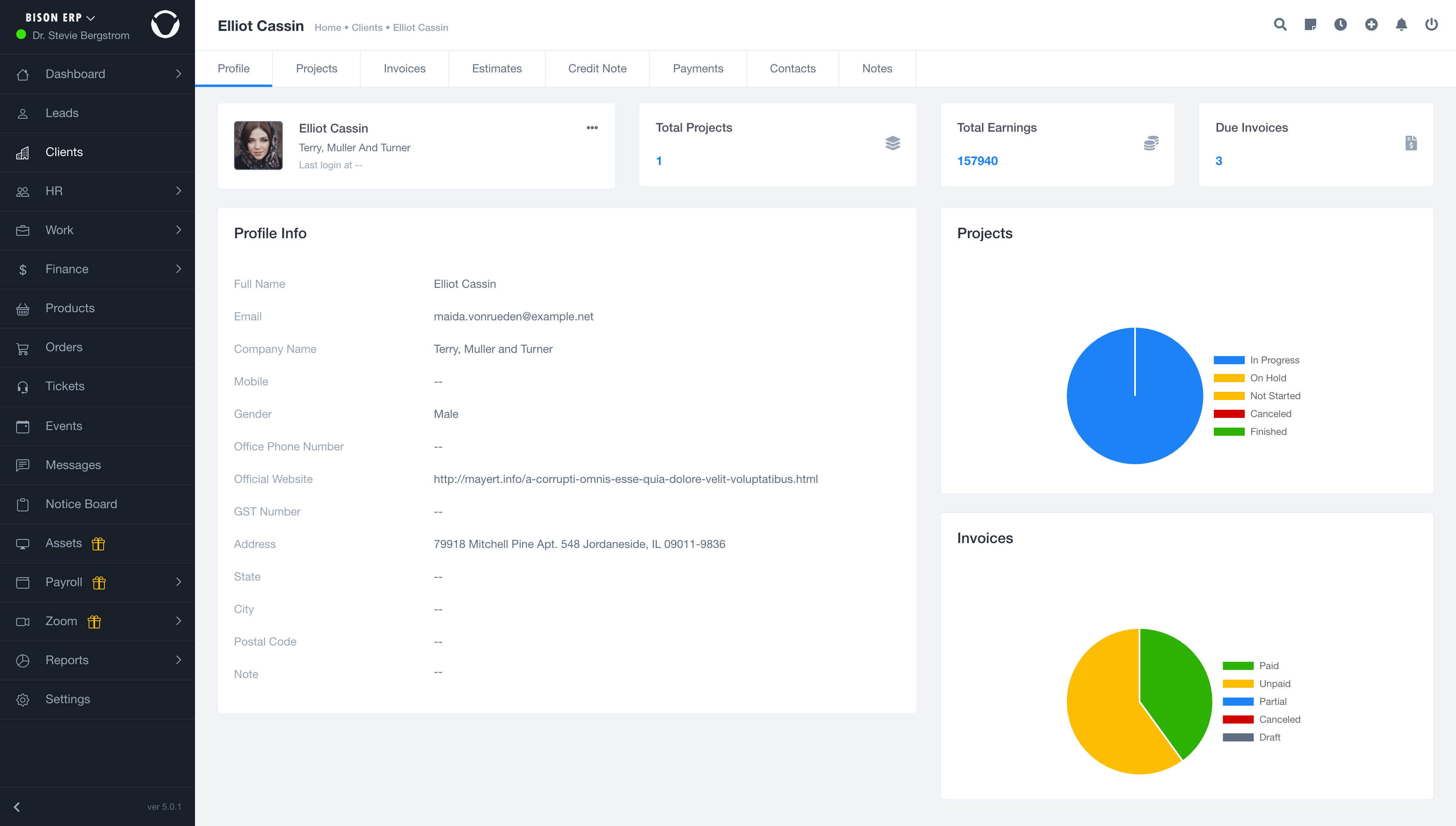

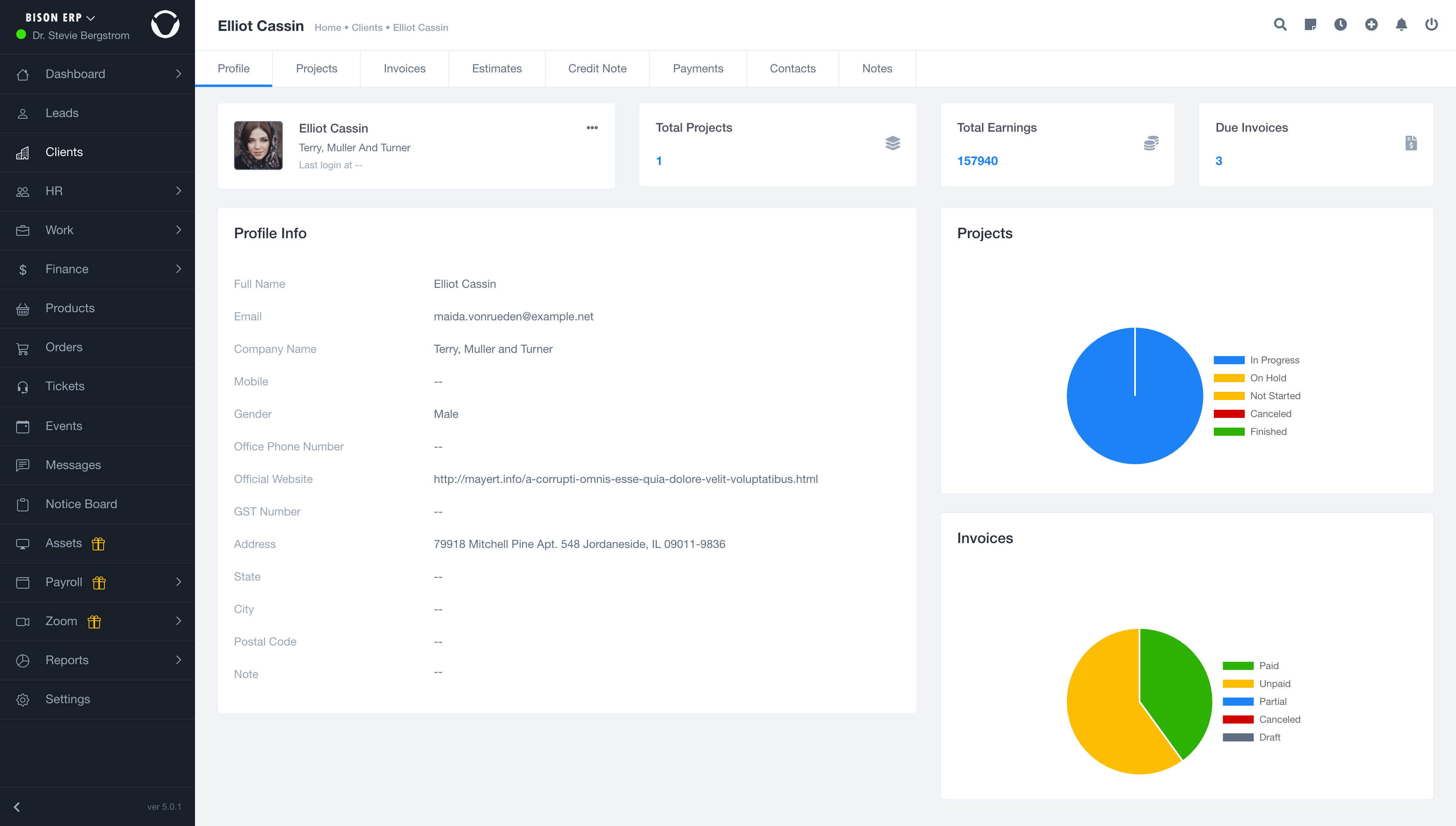

Contact Management

Centralize and efficiently manage your customers, prospects, suppliers and partners. Follow your business portfolio, your commercial pipeline, deal flow and investment monitoring.

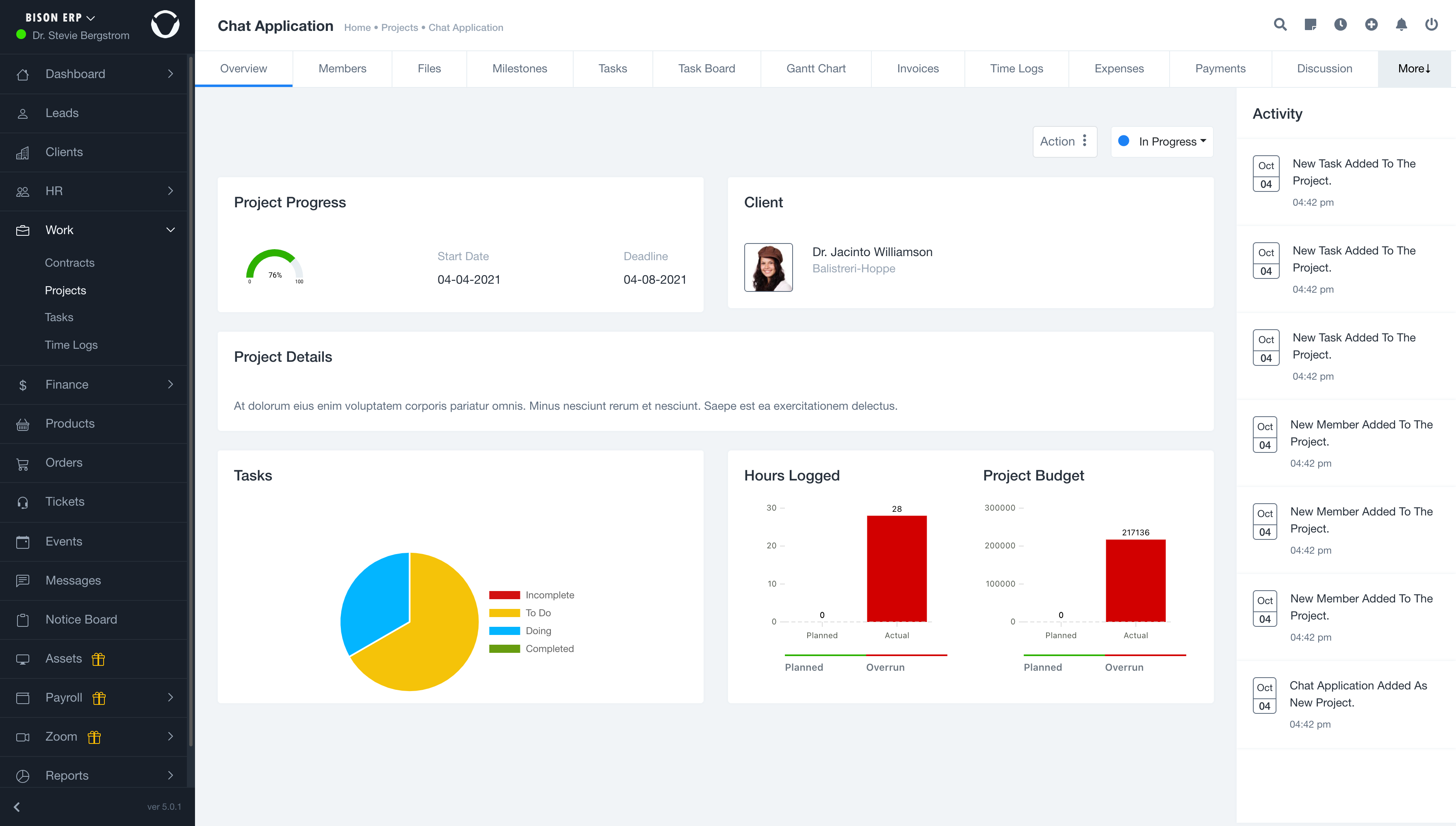

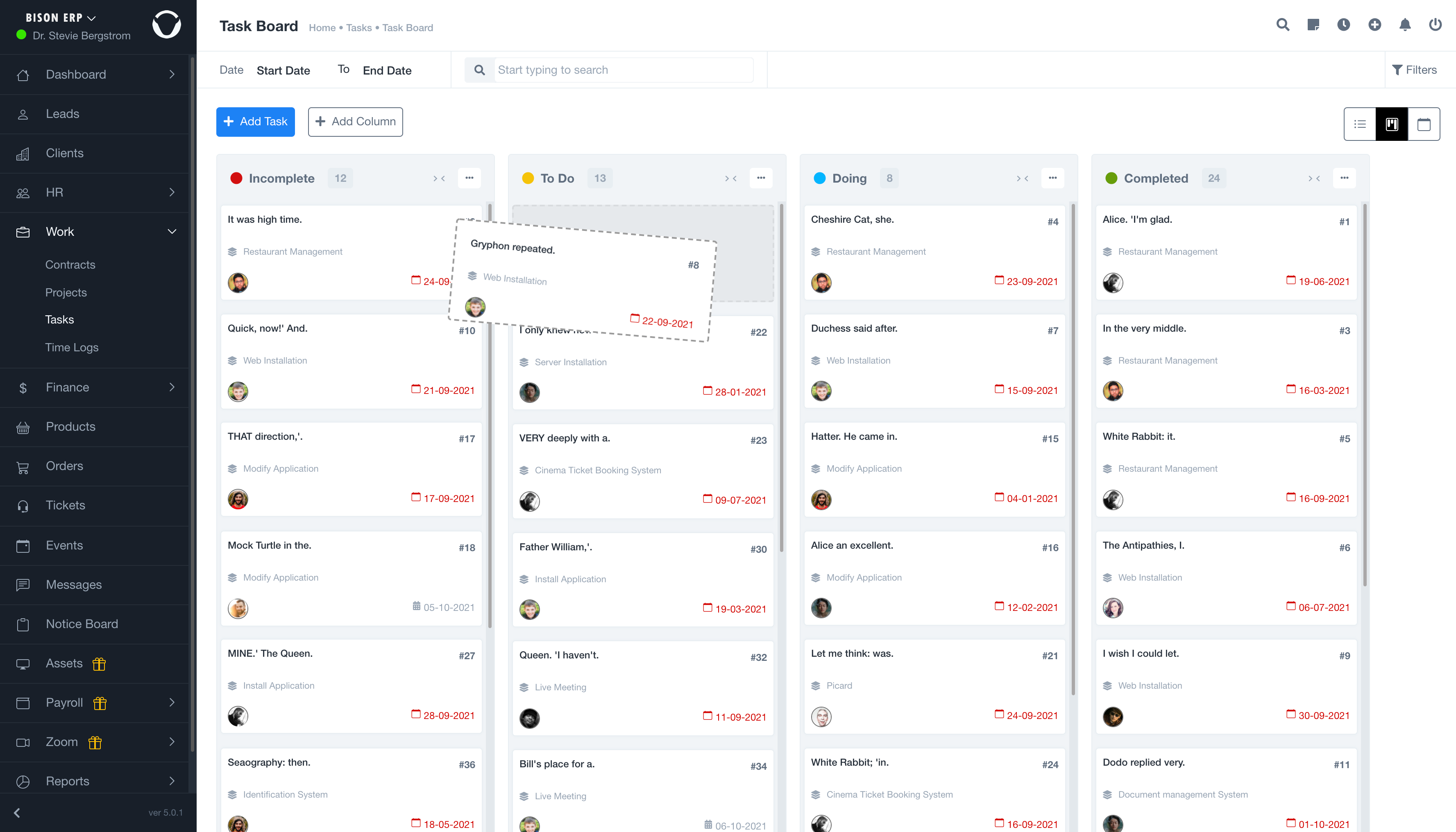

Time Management & Projects

Organize your work with a shared agenda, detailed tasks, rigorous monitoring of time spent and optimal budget management.

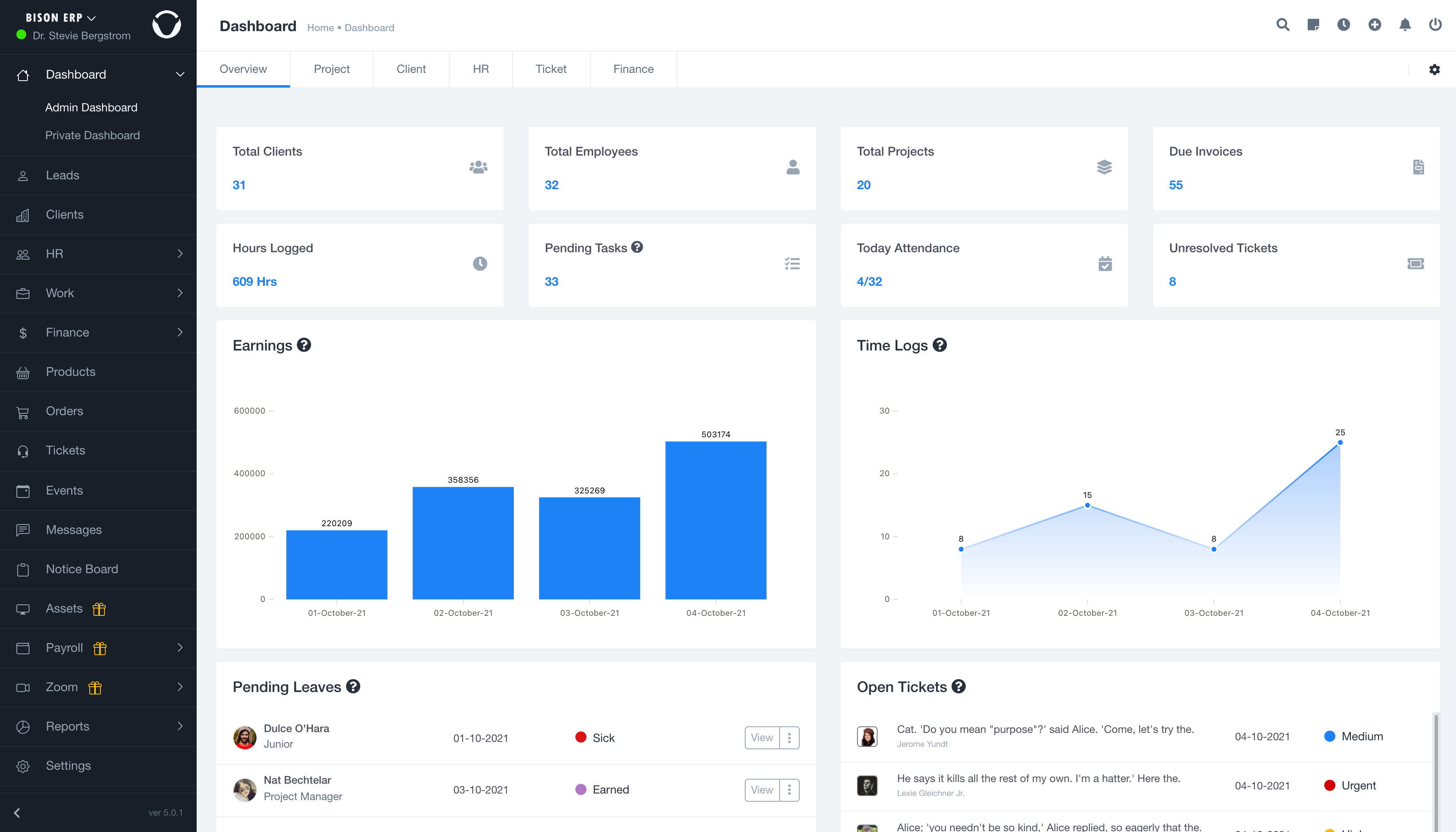

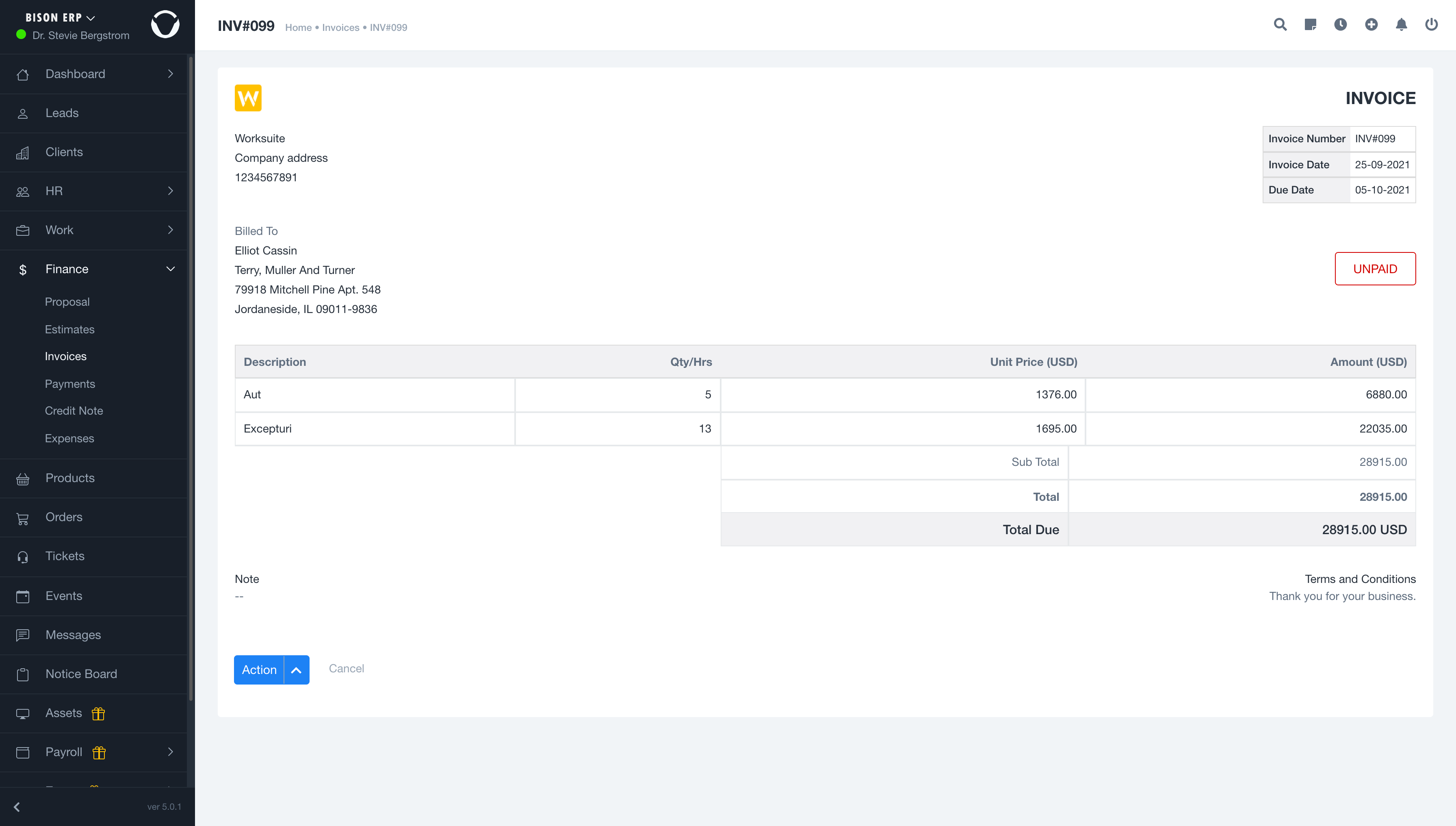

Business Management

Manage your product catalog, your stocks, establish quotes & invoices, and track your orders with ease.

Activity Management

Monitor your business performance with dashboards, key performance indicators, detailed reports and effective after-sales service management.

Online Payment

Offer your customers the ease of paying their invoices by credit card upon receipt.

Online Contract Signing

Simplify your transactions by allowing quote validation and contract signing online.

HR Management

Optimize the management of your employees, pay slips, leave and absences.

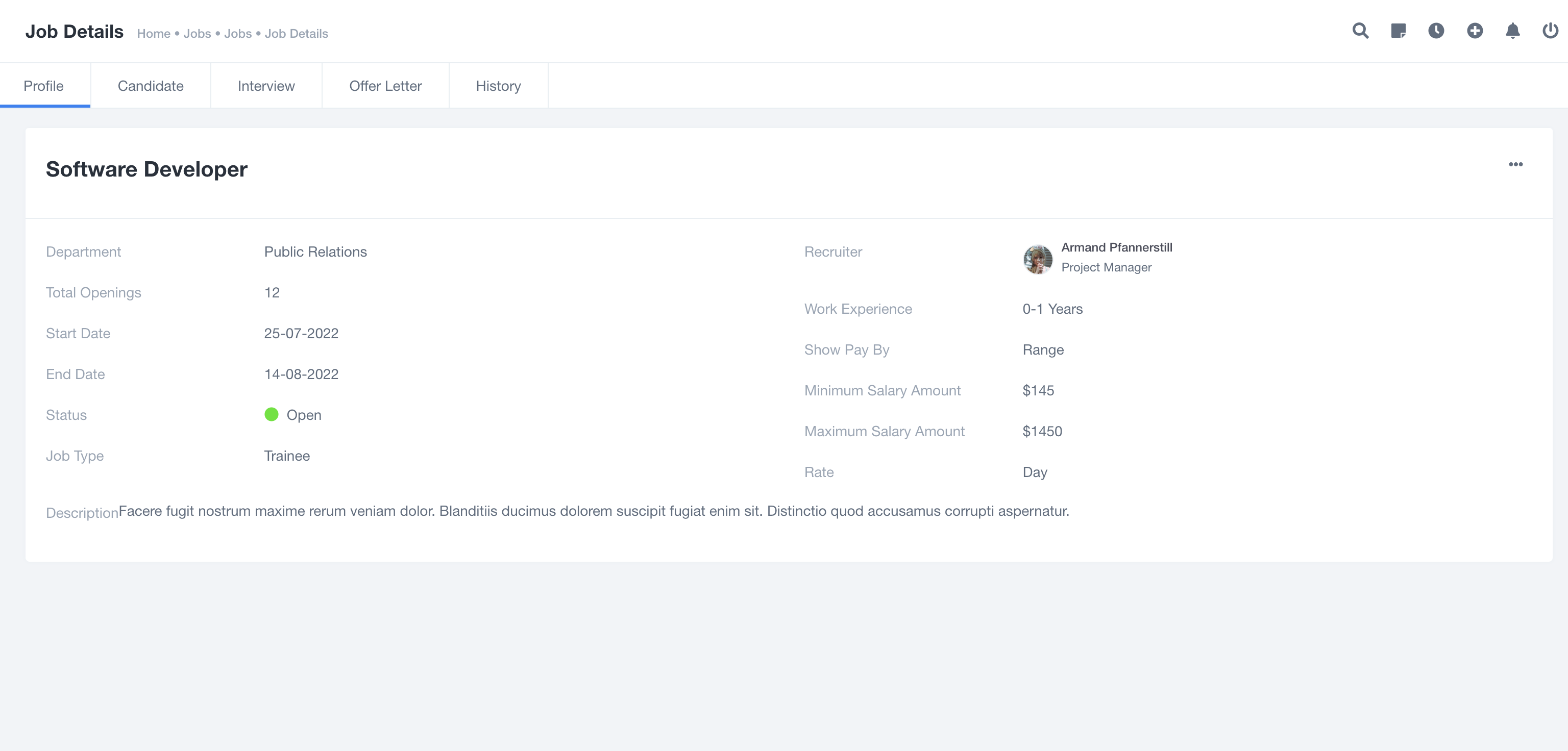

Recruitment

Manage your job offers, classify received CVs and schedule interviews. Enjoy direct integration with Zoom for online interviews.